Grain

Our Grain Advantages Count in Your Favor

We offer four good reasons to do grain business with AgState:

- Innovative risk-management products

- Marketplace leverage

- Harvest-season efficiency

- Grain operations safety

In our past, we were the hybrid created by an Iowa cooperative known for being among the first to ship unit trains. We also partnered with a world-class ag company known for its grain marketing savvy. Today when you do business with AgState grain, you reap the benefits of all we know and all we are willing to learn.

Iowa Grain Indemnity Fund

Grain Indemnity Fund 101 — Growers

Grain Policies

Click to view updated PDF of current grain policies

Sign up for text grain bids

Historical Cash Bids

The below chart is historical cash bid data. You can select your commodity, location, date and then click Get Chart. It will prepare a chart with the selected data. You may also choose the future harvest period to get what cash closed at for that month on the current date. Once the chart is populated, scroll your mouse over the line date to have that day’s bid appear.

AgState Grain Marketing

Your Partner in Risk Management Success

Take the guesswork out of grain marketing. Our expert team delivers customized strategies, real-time insights, and tools to help you maximize profitability while minimizing risk. Let our trusted AgState team help to protect your operation through every market shift.

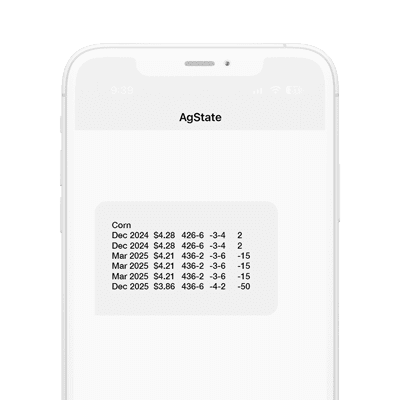

Cash — Futures + Basis

Basis — Establish basis for delivery month, set futures at a later date.

NBE (No Basis Established) — Establish futures price and set basis at a later date or upon delivery.

FOFR (Futures Offer) — Futures only offer that automatically sells if futures trade through established target price.

COFR (Cash Offer) — Cash only offer that automatically sells if cash price trades through established target price.

Seasonal Averaging Contract — Sells equal amount of bushels every day at the close during a specific time frame of your choosing.

- Accumulate prices during historical highs throughout the year

Extend Price — Receive a cash advance on bushels delivered and establish a long futures position on a deferred futures month of your choosing.

EMM (Equal Min. – Max.) — Sets a floor and a ceiling while selling an equal amount of bushels each trading day.

Minimum Price — Provides flexibility to establish a floor price.

Options — Establish a floor with upside potential or maintain upside on a current cash position.

Premium Offer — Premium is paid in exchange for a firm offer to sell additional grain for deferred delivery at an established price.

Accumulator — Sell at a premium to the market with the options of:

- No knockout accumulator

- Knockout accumulator

- No double up knockout accumulator

* Contracts denoted in black have potential contingent obligations if price closes AT or ABOVE agreed upon offer price on expiration. All contract details are governed by AgState and RJO/StoneX contracts and addendums.

Grain Originator Contacts

Don Loving

East Region

(712) 272-4114

Doug Stout

West Region

(712) 756-5460

Garrett Elbert

East Region

(712) 272-4114

Jim Porter

South Region

(712) 378-2888

Jim Totten

East Region

(712) 843-2291

LaKrecia Johnson

Northwest Region

(712) 852-3722

Regina Minary

Mid/South Region

(712) 284-2332

Ric Hofmeyer

West Region

(712) 756-5460

Robert Morris

Northwest Region

(712) 728-2382